Gift Aid

Increase the Value of Your Donations at No Cost to You

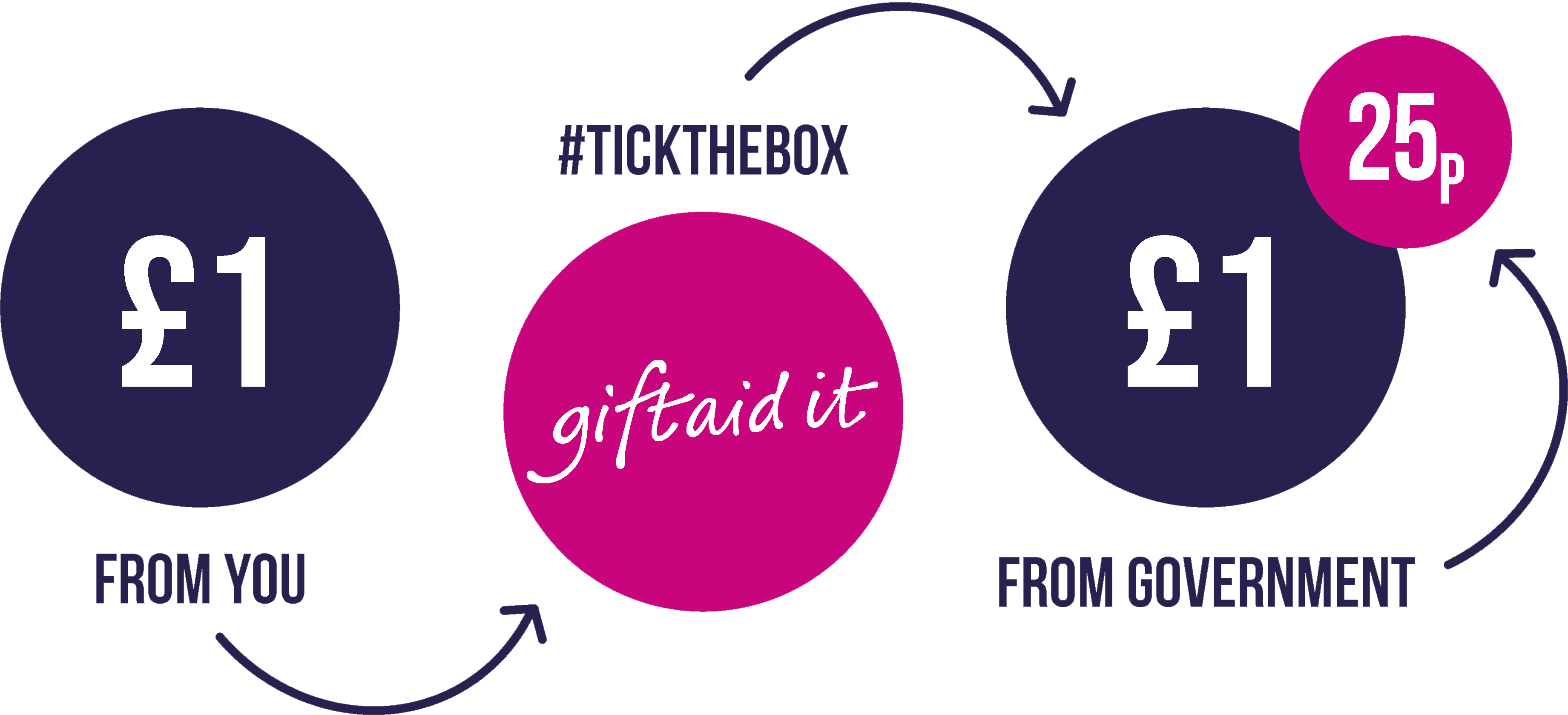

Gift Aid stands as one of the simplest and most effective methods of supporting charitable causes. Administered by HM Revenue & Customs, this scheme allows us to reclaim the basic rate tax you’ve paid as a UK taxpayer on your donations. It’s a powerful tool that adds significant value to your generosity, as for every £1 you donate, we can reclaim at least 25p through Gift Aid. The best part? This increase comes at absolutely no extra cost to you!

It’s important to note that to qualify for Gift Aid, the amount of income/capital gains tax you pay must be at least equal to the amount we’ll reclaim against your gift. This ensures that your donations make the maximum impact for the causes you care about.

How to Gift Aid Your Donation

At Checkout: When making your donation, simply select “Yes” to the Gift Aid question during the checkout process. It’s a straightforward step that can significantly boost the value of your contribution, allowing us to do even more good with your support.

By choosing to Gift Aid your donations, you’re empowering us to make a greater difference in the lives of those in need. Thank you for considering this option and for your continued support in our mission to create positive change. Together, we can achieve remarkable things.

Gift Aid is one of the most simple and comprehensive methods of donating to charity. It is an HM Revenue & Customs scheme that allows us to reclaim the basic rate tax you pay as a UK taxpayer.

It means that for every £1 you donate, we will receive an additional 25p at no extra cost to you. All we need is a one-time declaration, which you can provide by simply ticking a box on a form, online, or over the phone and we'll do the rest.

You can donate by calling 0333 305 5000 or by going online here.

Gift Aid can be applied to any amount donated by an individual, large or small – it all adds up! Cash, cheque, postal order, direct debit, standing order and bank card donations can all be Gift Aided.

You must be a UK taxpayer to be eligible for the Gift Aid scheme.

In the year that your gift is received by us, you must have paid income tax or capital gains tax in an amount at least equal to the amount that we will be reclaiming. Tax is claimed at the basic rate of taxation, which is 20% before taxes (25 percent on the net donation).

This means that under Gift Aid, Crisis Aid can reclaim at least an additional 25p from HM Revenue & Customs for every £1 donated.

If you are unsure whether you are eligible for Gift Aid, or simply want more information, contact HM Revenue & Customs by calling their Gift Aid helpline at 0151 472 6038 or visiting http://www.hmrc.gov.uk/.

No, a declaration is only required once. Your single declaration will apply to all past donations made in the six years preceding this year, as well as any future donations you may make to us.

Please keep us informed of any changes to your name or address. You can contact us at any time by sending an email to [email protected] or calling the Crisis Aid office at 0333 305 5000.

Even if you are a higher-rate taxpayer, we can only claim the basic rate of tax on your donation. However, you can reclaim the difference between what we reclaim and what you pay yourself through your tax return, or you can donate it back to Crisis Aid by filling out the information on your self-assessment form. All you have to do is remember to include information about your charitable contributions on your tax form.

You can cancel the declaration at any time by emailing [email protected] or calling 0333 305 5000 with your full name and address, including your postcode.

Anyone can give us permission to claim the tax paid on their gifts as long as they are a UK taxpayer and have paid the same amount of tax as we will claim on donations made in the tax year in which they were received.

This tax can be derived from income tax deducted from your pay check or from income / capital gains tax deducted from a private pension or savings interest.

State pension income is unlikely to qualify because you would need to earn more than the personal allowance threshold to pay income tax.

If this is your sole source of income, we recommend that you consult with your tax office before filing a declaration.

No. We reclaim the tax from HM Revenue & Customs directly (HMRC). To confirm that you are a UK taxpayer, simply check the box on the form.

That is all you need to do – though you may want to keep a record of your donations.

This is in case you are eligible for additional tax relief or to ensure that you are paying enough tax to cover the Gift Aid donations you make to charities.

We only have four years to claim the tax relief on your donations, so if you have made donations that are older than four years, we will only apply the tax relief to donations made within the allowed period as set by HMRC.

No. You only need to declare gifts made in the current tax year because, while the charity can claim tax back on donations made up to four years ago, you can only benefit from tax relief on donations made in the current year. If you have any doubts about your entitlement, please contact your tax office.