What Is Zakat?

Zakat is a compulsory form of charity and one of Islam’s five pillars. Learn its meaning, who must give it, and how it transforms lives across the world.

The Meaning of Zakat – Purification Through Giving

Zakat (زكاة) is an Arabic word that means purification or growth. In Islam, it refers to the obligatory charity that every eligible Muslim must pay once a year. It is not a voluntary donation, but a mandatory act of worship and one of the five pillars of Islam.

The purpose of Zakat is to purify one’s wealth, cleanse the heart from greed, and support the most vulnerable members of society. By giving a small portion of our excess wealth, we acknowledge that everything we have is a trust from Allah, and that we are responsible for sharing it with those in need.

The amount due for Zakat is typically 2.5% of wealth held for a full lunar year, such as savings, gold, silver, investments, business assets, and certain income. Zakat is only obligatory when your wealth exceeds the nisab threshold—an amount based on the value of gold or silver.

Zakat must be given to specific categories of people outlined in the Qur’an (Surah At-Tawbah 9:60). These include the poor, the needy, those in debt, stranded travelers, and others who qualify under Islamic law.

Through Zakat, wealth circulates through the community, helping reduce poverty and inequality. It is both a social safety net and a spiritual obligation that strengthens our connection to Allah and our fellow human beings.

Zakat is a reminder that true success lies not in accumulation but in generosity. When given with sincere intention, it not only helps others—it benefits the giver by purifying the soul and drawing one closer to Allah’s mercy.

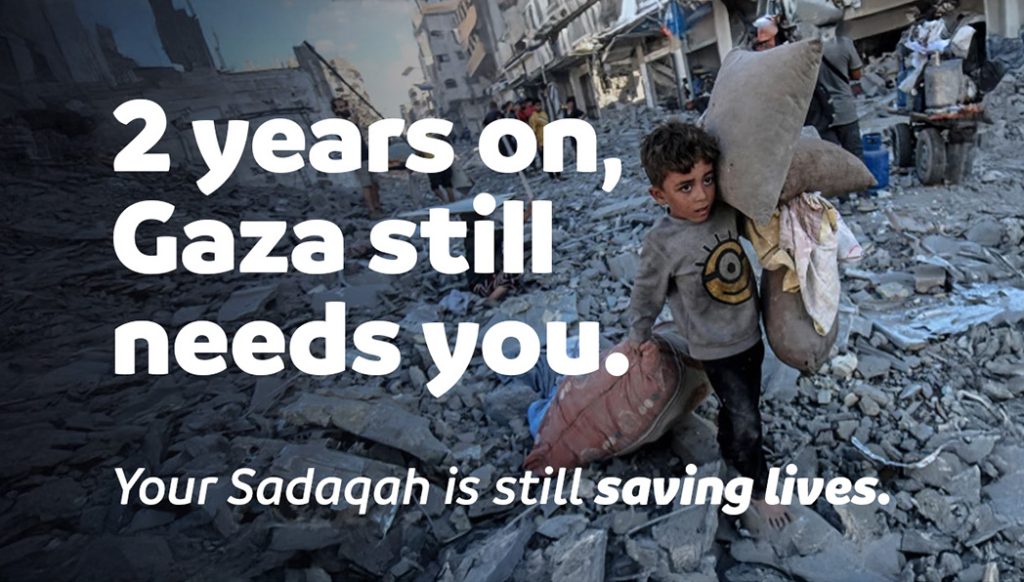

Gaza Emergency Appeal

Food For Life

Zakat

Sadaqah Jariyah

Quran Memorisation

Who Must Pay Zakat and Who Can Receive It?

Zakat is a duty for every adult Muslim who is mentally sound and whose wealth meets or exceeds the nisab level. This threshold is based on the value of either 87.48 grams of gold or 612.36 grams of silver. If your total wealth (after debts) remains above this amount for one lunar year, Zakat becomes obligatory. You are required to pay Zakat on various types of wealth, including cash savings (bank or at home), gold and silver, business stock and investments, rental income, and, in some cases, agricultural produce or livestock. It is important to calculate your Zakat accurately to ensure you fulfill your obligation correctly. Many Muslims use online Zakat calculators or consult Islamic scholars to determine the exact amount.

The Qur’an identifies eight categories of eligible recipients for Zakat (Qur’an 9:60), which include the poor (al-fuqara’), the needy (al-masakin), Zakat administrators, those whose hearts are to be reconciled, those in bondage (such as enslaved or trafficked individuals), those in debt, those striving in the cause of Allah, and the stranded traveler (ibn al-sabil). Zakat should be given only to those who fall under these categories and cannot be used for building mosques, general charity, or personal benefit. It’s also important to note that Zakat should not be given to immediate family members whom you are already financially responsible for (such as children or parents), but it can be given to extended relatives who qualify and are eligible.

By giving Zakat, you’re not only fulfilling a religious command but actively fighting poverty, injustice, and inequality in the world. It is a form of social justice that brings benefit to both the giver and the receiver, spiritually and materially.