How to Calculate Zakat

Need help calculating your Zakat? Use this step-by-step guide to find out how much Zakat you owe and who should receive it. Easy, accurate, and Shariah-compliant.

Calculating Your Zakat

Calculating your Zakat accurately is a vital step in fulfilling this sacred obligation with sincerity and clarity. Begin by confirming that your total wealth meets or exceeds the nisab—the minimum threshold—based on the current value of 87.48 grams of gold or 612.36 grams of silver. Next, carefully list all your zakatable assets, including cash, gold, business inventory, investments, rental income, and any money owed to you that you have possessed for a full lunar year. Subtract any immediate debts or essential expenses from this total.

Once you have your net amount, calculate 2.5% to determine the exact Zakat due. This calculation ensures your charity is both accurate and meaningful, aligning with Islamic principles.

Finally, distribute your Zakat to those eligible as specified in the Qur’an—such as the poor, needy, and debtors. Choosing to donate through a trusted charity like Crisis Aid guarantees your Zakat reaches genuine recipients with full transparency, respect, and integrity, turning your duty into real, life-changing impact.

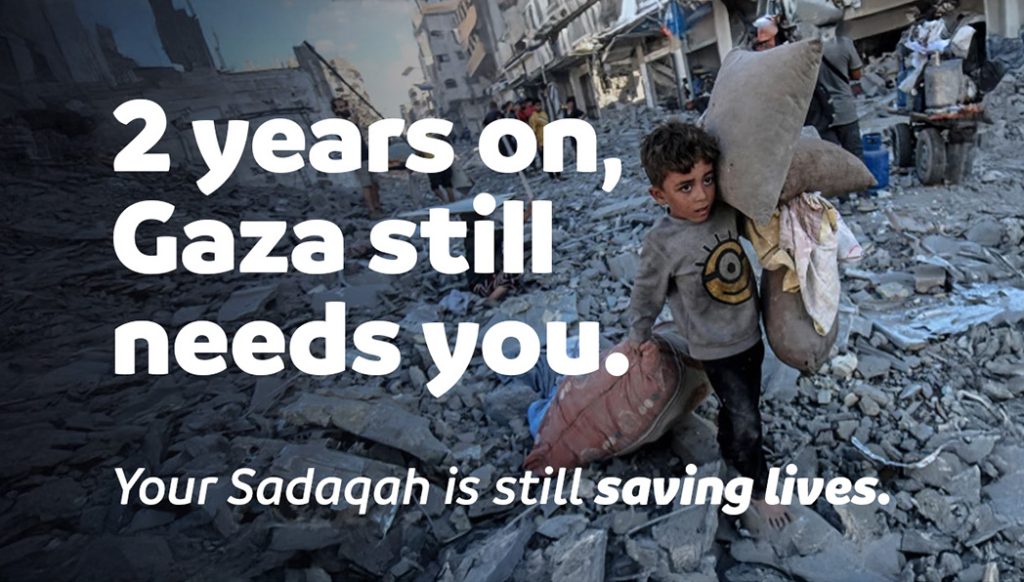

Gaza Emergency Appeal

Food For Life

Zakat

Sadaqah Jariyah

Quran Memorisation

ommon Questions About Zakat Calculation

The nisab—the minimum amount of wealth that makes Zakat obligatory—changes with market prices, and many scholars recommend using the silver nisab to extend help to more people, while others prefer gold as a benchmark. You can find current nisab values on trusted Islamic finance websites or easily check them using Crisis Aid’s free Zakat Calculator.

Zakat applies to gold jewellery if its total value surpasses the nisab and has been held for a full lunar year, although opinions vary on whether personal jewellery worn regularly is exempt. For pensions and investments, Zakat is due if you have access to defined contribution pensions or if shares are held for resale; the exact calculation depends on the type of asset.

When deducting debts, only short-term liabilities—such as bills or loans due within a month—can be subtracted fully. Long-term debts are usually considered partially, often by accounting for one year’s worth of payments rather than the total amount owed.

Using tools like Crisis Aid’s online Zakat Calculator simplifies this process, ensuring your calculation is accurate and compliant with Shariah. Remember, Zakat is more than numbers—it’s a spiritual act that purifies your wealth, earns Allah’s pleasure, and provides critical support to those in need.