Zakat on Savings

Zakat must be paid on savings that exceed the nisab and are held for one lunar year. Learn how to calculate your Zakat on cash, bank deposits, and digital savings.

Understanding Zakat on Savings – A Step-by-Step Guide

Zakat on savings is one of the most common types of Zakat today, especially for Muslims living in modern economies like the UK. Whether your money is kept at home, in bank accounts, or stored digitally, Zakat is due if your savings exceed the nisab threshold and have been held for a full lunar year (hawl).

This includes cash at home, funds in current or savings accounts, emergency reserves, fixed deposits, online wallets, and even foreign currency balances converted to local currency.

To calculate, first determine your nisab by checking the current market price of 87.48 grams of gold or 612.36 grams of silver in your currency. Next, total all savings you’ve held for one lunar year, subtract any immediate liabilities like unpaid bills or loans, and then pay 2.5% of the remaining amount.

For example, if you have £8,000 in savings with no debts, your Zakat due is £200. Even if your savings are reserved for future expenses such as a house or wedding, Zakat must still be paid unless the funds are actively in use or required for essential living.

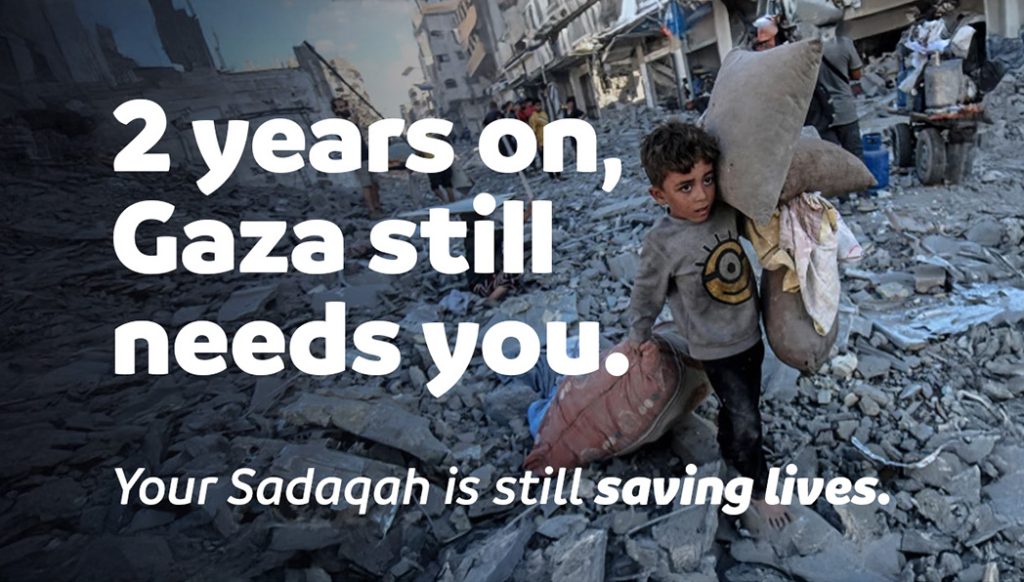

Gaza Emergency Appeal

Food For Life

Zakat

Sadaqah Jariyah

Quran Memorisation

FAQs on Paying Zakat on Savings

Zakat is due on all types of bank accounts that hold your liquid savings, including current accounts, savings accounts, fixed-term deposits, and interest-free schemes like ISAs (as long as the funds are halal). For interest-bearing accounts, you should separate out any interest earned and give it as charity, not as Zakat.

Emergency or future-use funds are also subject to Zakat if they meet the nisab and have been held for a full lunar year. This applies even if you’ve earmarked the money for specific goals like Hajj, marriage, or education, since Zakat is due on wealth in your possession.

If your savings fluctuate throughout the year but generally stay above the nisab, you calculate Zakat based on your balance at the end of the lunar year. While some scholars suggest averaging monthly balances, the simplest approach is to pay 2.5% on whatever you have at year-end.

Zakat is not obligatory on children’s savings unless they are mature and responsible (mukallaf). However, many parents choose to pay Zakat on their children’s behalf when amounts are significant.

Paying Zakat on your savings purifies your wealth and helps support those in need. Though it’s only a small percentage, its impact is great. Use Crisis Aid’s Zakat Calculator to calculate and give your Zakat safely, correctly, and with full intention.