Zakat on Property

Wondering if Zakat applies to your home, rental property, or land? Understand when and how Zakat is due on property assets, and how to calculate it correctly.

Is Zakat Due on Property? Understanding the Rules

Zakat on real estate depends largely on how the property is used and your intentions for it. Your primary residence—the home where you live—is exempt from Zakat, as personal-use properties are not subject to this obligation.

If you own rental properties, Zakat is not due on the property’s value itself, but rather on the rental income you receive and retain for a full lunar year, provided that income meets or exceeds the nisab threshold. For instance, if your rental income totals £12,000 annually and you have £4,000 in related expenses, your net income of £8,000 would be subject to 2.5% Zakat, which amounts to £200.

Properties held as investments for resale are considered business assets. In this case, Zakat is calculated annually on the current market value of the property. For example, if an investment property is valued at £50,000, your Zakat due on it would be £1,250.

Vacant land or second homes that are neither rented out nor intended for resale are generally not subject to Zakat, unless your intention changes to use them commercially. Your original purpose when purchasing the property is crucial in determining your Zakat liability; if your plans shift, your Zakat obligations may change accordingly.

Understanding these distinctions ensures you fulfill your Zakat responsibly and accurately, maintaining your commitment to Islamic principles while managing your assets wisely.

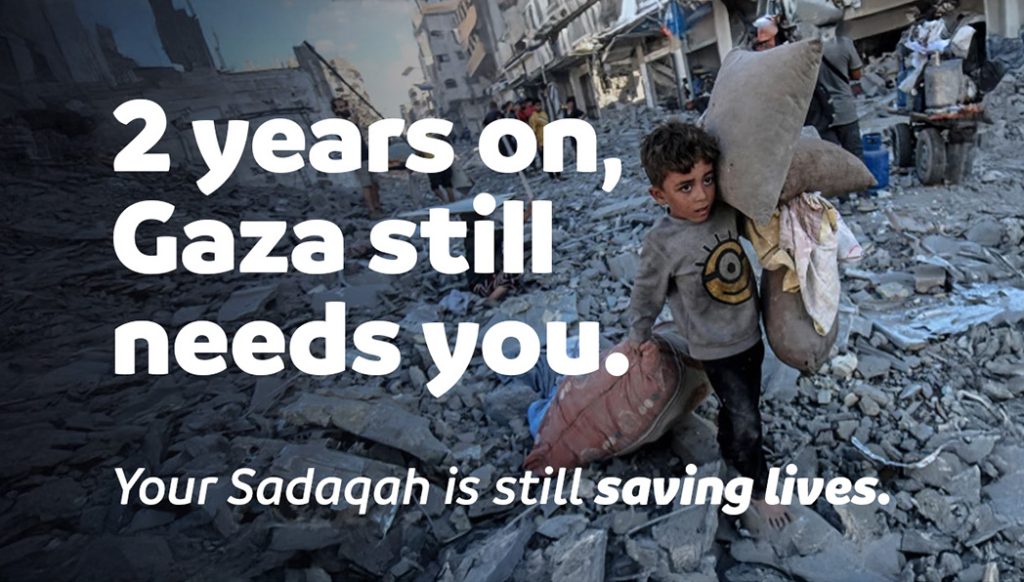

Gaza Emergency Appeal

Food For Life

Zakat

Sadaqah Jariyah

Quran Memorisation

How to Calculate Zakat on Rental Income and Investment Property

If you earn rental income from property, Zakat is due on the net income—not the property’s value. To calculate this, first track your total rental income for the year (e.g., £1,000 per month equals £12,000 annually). Then deduct legitimate expenses such as maintenance, service charges, property management fees, and mortgage interest (but not the principal). For example, if expenses total £4,000, your net income is £8,000. If you retain this amount for a full lunar year and it exceeds the nisab threshold (roughly £380 to £4,000, depending on gold or silver value), you pay 2.5% Zakat on it—£200 in this case.

For property purchased with the intent to resell for profit, Zakat is due annually on its current market value, even if it hasn’t sold yet. If the market value fluctuates, calculate Zakat based on the fair price at your Zakat due date.

If you own multiple properties, calculate Zakat separately: 2.5% on net rental income from rented properties, 2.5% on the market value of resale properties, and no Zakat on personal-use homes.

If unsure, use Crisis Aid’s Zakat Calculator or consult a qualified scholar to ensure your Zakat is accurate and compliant with Islamic law.