Zakat al-Mal

Zakat al-Mal is a mandatory Islamic charity on accumulated wealth. Discover how to calculate it, who must pay, and why it purifies your wealth and benefits those in need.

What Is Zakat al-Mal? Understanding Its Meaning and Importance

Zakat al-Mal is a sacred obligation and a pillar of Islam—more than just a charitable payment, it is a powerful act of worship that purifies wealth, uplifts the needy, and strengthens the bonds of mercy within the Ummah. It is due once a Muslim’s total wealth surpasses the nisab threshold and has been held for a full lunar year. This includes cash, savings, gold, silver, business assets, and certain investments that are not in personal daily use.

The standard rate of Zakat al-Mal is 2.5% of your zakatable wealth. It must be given to those who fall within the eight eligible categories named in the Qur’an, including the poor, the needy, and the heavily indebted. This precise calculation ensures that your wealth is cleansed while simultaneously empowering the most vulnerable in society.

Giving Zakat al-Mal through a trustworthy and Shariah-compliant charity like Crisis Aid means your obligation is fulfilled with integrity and care. Your donation is directed only to those eligible under Islamic law, ensuring that every pound you give honours your religious duty and makes a real impact on lives in need.

Through your Zakat, you express gratitude to Allah, protect your wealth from arrogance and neglect, and help build a just society where no one is forgotten. It is a divine trust—and when given with sincerity, it becomes a light in your life and in the lives of those it touches.

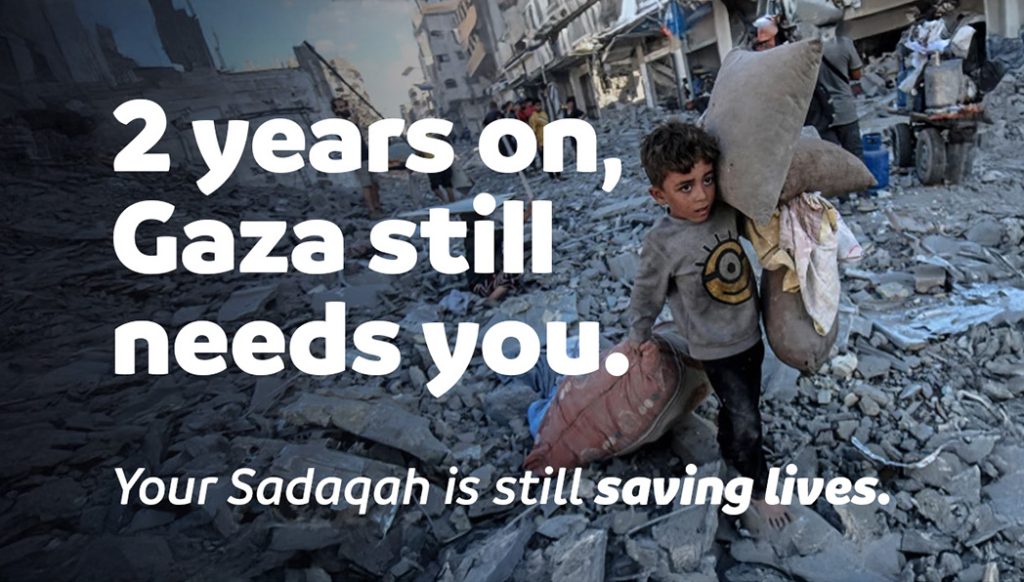

Gaza Emergency Appeal

Food For Life

Zakat

Sadaqah Jariyah

Quran Memorisation

How to Calculate Zakat al-Mal – Step by Step Guide

Calculating Zakat al-Mal becomes clear and manageable when you understand the key steps rooted in Islamic guidance. Start by identifying all your Zakatable assets—this includes your cash in hand, savings in bank accounts, gold, silver, business stock, and any investments held for income or resale. These are the assets Islam considers subject to purification through Zakat.

Next, check the current nisab value using the price of gold or silver, depending on which benchmark you follow. Your total wealth must meet or exceed this threshold to make Zakat obligatory. Then, confirm that this wealth has been in your possession for one full Islamic lunar year—this duration is called a hawl and is essential in determining your obligation.

Before calculating your final Zakat amount, subtract any immediate debts or liabilities due within the short term. This ensures that your calculation reflects only the wealth you truly own and control. With your net Zakatable wealth determined, simply multiply it by 2.5 percent to find the amount due.

For example, if your eligible wealth after deductions totals £10,000, then your Zakat al-Mal obligation would be £250. This small portion of your wealth becomes a powerful act of worship, supporting those in need and purifying the rest of your earnings in the sight of Allah.

By giving your Zakat with sincerity and care, you fulfil a sacred duty, uphold social justice, and draw closer to the mercy of your Creator.