Zakat on Gold

Zakat is due on gold that exceeds the nisab and has been owned for a year. Discover how to calculate Zakat on your jewellery in a simple and Shariah-compliant way.

Do You Pay Zakat on Gold? The Ruling Explained

In Islam, gold is considered a form of wealth that accumulates value and is therefore subject to Zakat. Whether held as jewelry, coins, or bars, Zakat becomes obligatory on gold when two conditions are met: the total amount you own reaches or exceeds the nisab threshold, and you have possessed it for a full lunar year. The nisab for gold is 87.48 grams (approximately 3 ounces). If your gold holdings meet or exceed this amount, you must pay 2.5% of its current market value as Zakat.

There are differing scholarly views regarding gold jewelry worn regularly. The majority, including Hanafi scholars, advise paying Zakat on all gold, including personal jewelry, while some exempt jewelry used regularly and not excessive. To ensure purification of wealth and avoid doubt, many Muslims choose to pay Zakat on all gold they own.

To calculate your Zakat on gold, weigh your gold accurately, check the current market price per gram, multiply the weight by the price to find the total value, then multiply by 2.5% to determine the amount due. For example, if you own 100 grams of gold priced at £50 per gram, the total value is £5,000, and your Zakat due is £125. Using Crisis Aid’s Zakat Calculator can help you quickly and accurately determine your obligation so you can give confidently.

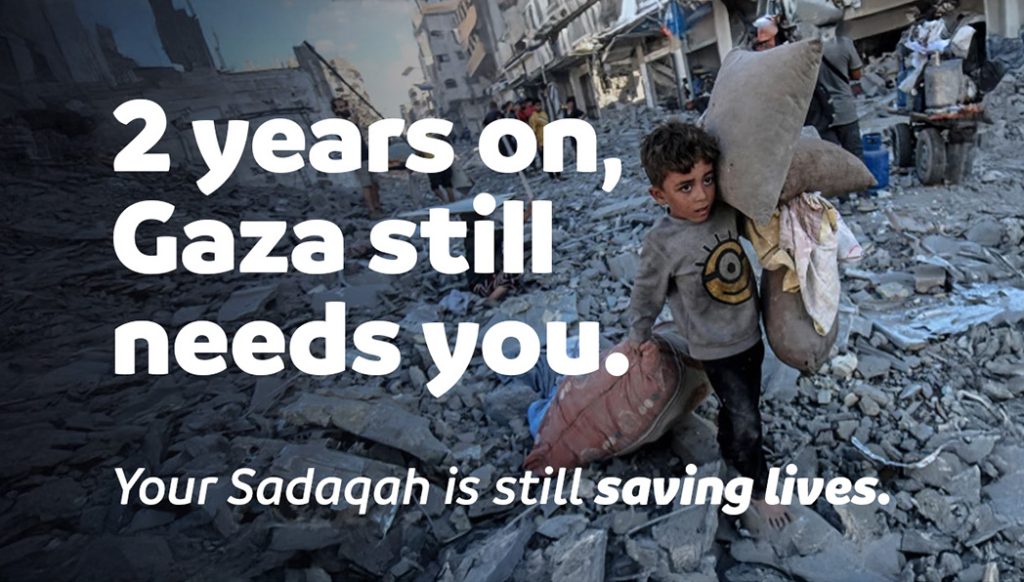

Gaza Emergency Appeal

Food For Life

Zakat

Sadaqah Jariyah

Quran Memorisation

How to Calculate Zakat on Gold Jewellery

Calculating Zakat on gold jewellery can be complex, but it is essential to fulfil this important obligation correctly. Gold jewellery commonly owned by Muslim women—including necklaces, rings, earrings, bangles, and even gold coins or bars—must be carefully assessed. Most scholars agree that Zakat is due on all gold above the nisab threshold of 87.48 grams, whether it is worn regularly or kept as an investment. When unsure, it is safer to include all gold items to ensure your Zakat is complete.

To calculate your Zakat, start by weighing your total gold using a jeweller’s scale, a reliable kitchen scale, or by consulting a trusted jeweller. Then, find the current market price of gold from reputable sources such as the London Bullion Market or verified online calculators. Multiply the total weight of your gold by the current price per gram to determine its total value.

Once you have this figure, calculate 2.5% of it as your Zakat amount. For example, if you own 120 grams of gold priced at £55 per gram, your total gold value is £6,600. Your Zakat due would then be £165.

You may pay this amount in cash, or if feasible, give the actual gold itself to those eligible. Crisis Aid ensures that your Zakat on gold is distributed fully in accordance with Islamic law, reaching those who need it most—orphans, widows, the sick, and impoverished families across the globe.

By entrusting your gold Zakat to Crisis Aid, you fulfil your religious duty with confidence, knowing your generosity is handled with integrity, transparency, and deep respect for Islamic principles.