Zakat Percentage

The standard Zakat percentage is 2.5% of your wealth held for a year. Learn how to calculate Zakat and ensure your giving is accurate, effective, and Shariah-compliant.

Second Title: What Is the Zakat Percentage and How Is It Applied?

Zakat, one of the Five Pillars of Islam, requires every eligible Muslim to give 2.5% of their qualifying wealth held for a full lunar year. This includes assets like cash, gold and silver, business inventory, savings, investment and rental income (after expenses), and certain shares or pensions. The 2.5% rate is based on authentic Hadith and scholarly consensus.

To owe Zakat, your total wealth must exceed the nisab threshold, calculated by the value of either 87.48 grams of gold or 612.36 grams of silver—roughly £380 (silver) or £4,000 (gold) today, though market prices fluctuate. After confirming your wealth is above nisab and has been held for one lunar year, you subtract any immediate debts and calculate 2.5% of the remainder.

For example, if you have £10,000 in Zakatable assets, your Zakat due is £250.

Paying Zakat is not merely a financial duty but a spiritual act of worship that purifies your wealth and fulfills your obligation to Allah. To ensure your calculation is accurate and Shariah-compliant, you can use Crisis Aid’s Zakat Calculator.

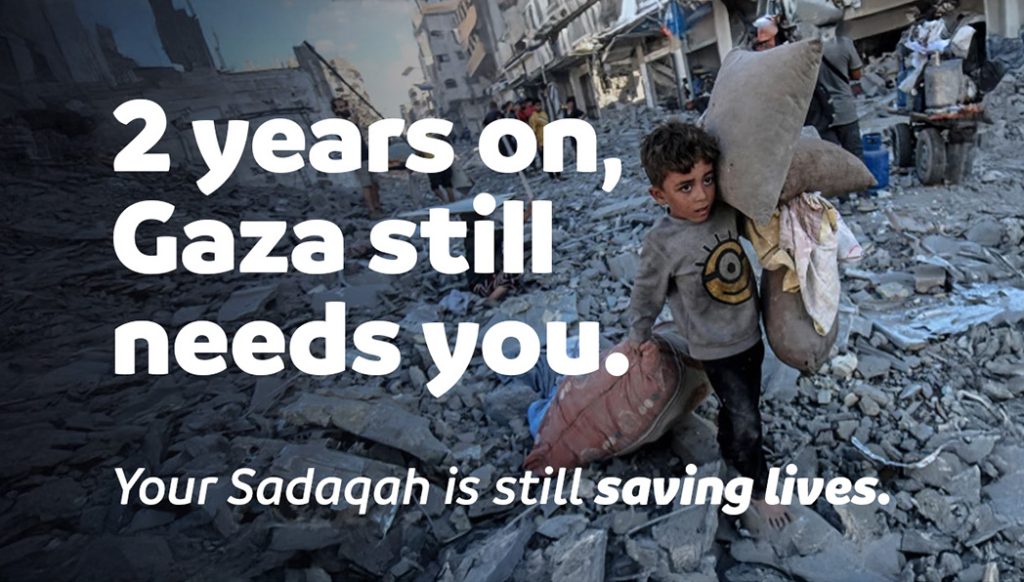

Gaza Emergency Appeal

Food For Life

Zakat

Sadaqah Jariyah

Quran Memorisation

Why 2.5%? The Wisdom Behind the Zakat Rate

The 2.5% Zakat rate is far from arbitrary—it embodies divine wisdom and social justice in Islam. This fixed percentage ensures wealth circulates from those with surplus to those in need, without imposing undue hardship on the giver. For every £100 saved over a lunar year, only £2.50 is given as Zakat—a modest amount individually, yet collectively it forms a powerful system that uplifts the poor, clears debts, and strengthens the community.

Since the time of the Prophet Muhammad ﷺ, this 2.5% rate has been consistently applied, striking an ideal balance between preserving personal wealth and fulfilling spiritual and social responsibilities. While 2.5% applies to most personal wealth like cash, gold, silver, and business assets, other rates apply in specific cases—such as 5%, 10%, or 20% for agricultural produce depending on irrigation methods, and special rules for livestock and trade goods.

Zakat is not due on personal-use items like your home, car, clothes, or furniture—only on excess, productive wealth. Giving this 2.5% annually purifies your remaining wealth (tazkiyah), increases blessings (barakah), strengthens your character, and safeguards your resources.

At Crisis Aid, we make calculating and giving your Zakat straightforward and Shariah-compliant. Our secure platform ensures your 2.5% reaches eligible recipients—orphans, widows, and families in need worldwide—so your charity truly makes a difference.